Insurance Solutions Experts

BTAG is a business consulting firm specializing in providing solutions for the insurance industry. Our products and solutions are currently being utilized by major insurance carriers across many platforms. For our clients, we are successfully extending the life of their legacy systems by adding options such as Automated Agency Interfaces, State Reporting, Data Warehousing and Actuarial Reporting System. We assist our clients with integration of Billing, Claims, Financial and Reinsurance Systems with their core insurance processing systems. And if necessary helping them migrate to current technologies. In addition to our Business and Technology Consulting Services, we have designed several Products and implemented effective Solutions Frameworks for our customers. We have found that our client’s business approach to the marketplace, product mix, corporate culture and underwriting results are different, but their information processing needs tend to be similar. Because of this, we can maximize our experience, products and solution frameworks during our engagement. Our developed set of designs, applications and pre-built system templates can be easily customized to meet specific needs. Our products and solutions frameworks are very flexible and are currently being utilized by several major insurance companies today.

The BTAG members have worked with hundreds of insurance companies

- Focused on middle market P&C insurance carriers

- Depth of experience in specialty lines

- Worked the MGA and Agents

- Statically consulting for the largest P&C insurance companies

- Frequency called upon as Subject Matter Experts (SME)

- Speaker at P&C insurance events

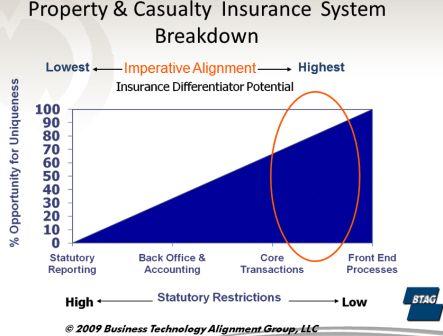

P&C Opportunity for Uniqueness

Our Senior Consultants and Executive Team have been working and consulting in the P&C insurance industry for over 100 combined years. We have worked in all aspects and most lines of business. From that depth of experience, BTAG has a specialty area of concentration in P&C Front End Processes. This is the area that directly touches the insurance companies' client and the area that has the highest quotient for being unique. And with caution, is the process segment that needs to be the most aligned to the end client. BTAG is positioned to help our clients both realize this uniqueness - while keeping it aligned to the overall business strategy. Aligning the CIO and CMO to meet the common goal of a great customer experience.